QuickBooks Online is a great choice for a variety of field industries. It enables you to manage the various components of a business, from estimate development to team cooperation and work cost reports. But is it a good choice for contractors?

The answer is yes! QuickBooks for contractors is not just good, but a great choice when it comes to accounting software.

As a contractor, you understand how difficult it can be to maintain order and make sound financial decisions while also managing your business. And here is where QuickBooks Online shines as a valuable resource for contractors. From tiny handyman businesses to major commercial jobs, the program includes a variety of user-friendly features to help your business function smoothly.

Field Promax Contractor Management Software Offers the Best QuickBooks Online Integration. Sign Up Now.

QuickBooks is one of the best accounting solutions for small businesses, and it’s a terrific place to start toward an organized accounting system for contractors just starting out. While it is not particularly intended for construction, it is intended to be useful for a variety of businesses.

As a result, contractors continue to reap the rewards of using QuickBooks Online for contractors. Of course, the amount varies. But overall, it is indeed an efficient tool to enhance your bookkeeping and accounting tasks, as well as improve your business processes for better productivity.

Here is why it is a good idea to use QuickBooks for construction companies:

1. Easy to Use

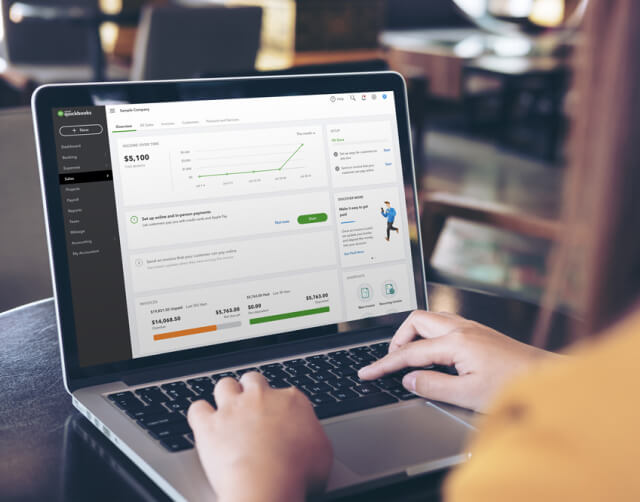

One of the most appealing aspects of QuickBooks Online for construction contractors is its ease of use. Of course, this is dependent on the range of features and alternatives offered. However, basic invoice entry can be extremely simple, and linking your QuickBooks Online account to bank accounts can make importing transactions a breeze. Some customization options also allow you to customize major reports, so you can experiment with them and save them for later.

This essentially means that you don’t need good accounting experience to utilize QuickBooks properly. Don’t understand the difference between “credits” and “debits”? That’s OK. The easy entry windows, like in a lot of other accounting software solutions, handle most of that for you. Aside from delving into some of the more advanced features, such as adjusting your journal entries or integrating third-party apps, you shouldn’t need much prior knowledge to get minimal value.

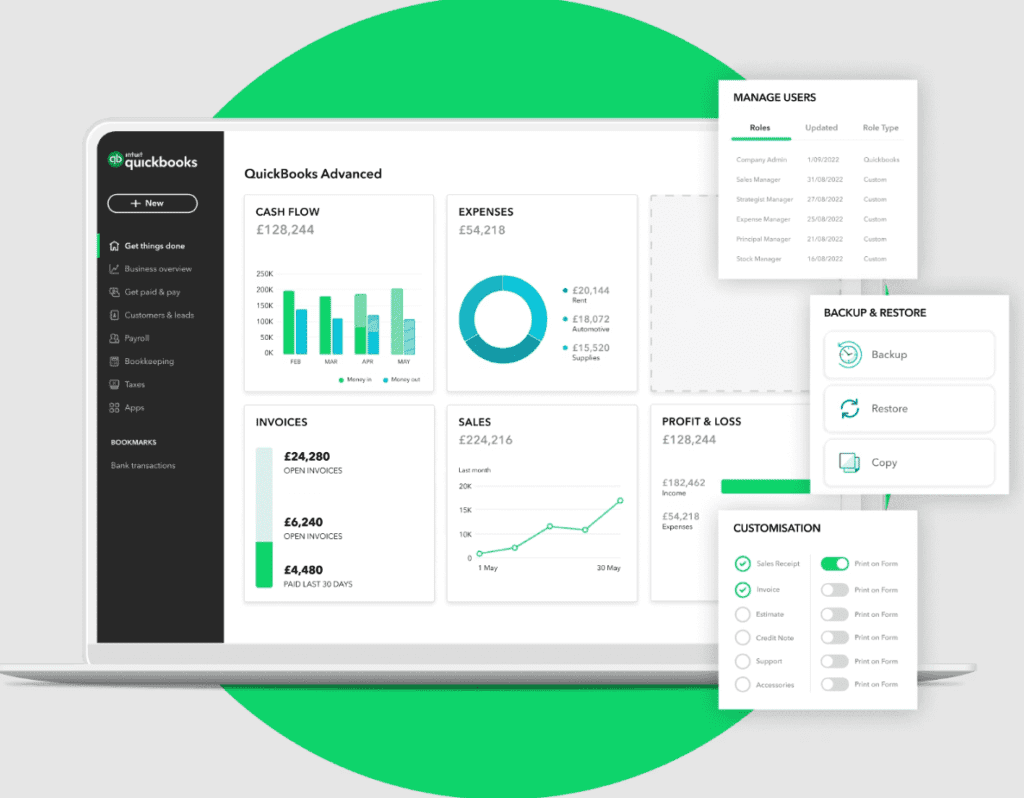

2. Cloud Accounting

QuickBooks has just transitioned its users to a fully cloud-based accounting platform. That is, you can access it from anywhere there is an Internet connection. That could be your office desktop or the brand-new laptop you just purchased. There are no downloads or installations with cloud software.

Of course, another advantage of using the cloud is that backups are handled automatically, and the servers on which your software runs are professionally guarded. Using QuickBooks, contractors can really benefit from this feature.

Try Field Promax for the Best Cloud Technology with QuickBooks Integration. Book A Free Demo to Learn More.

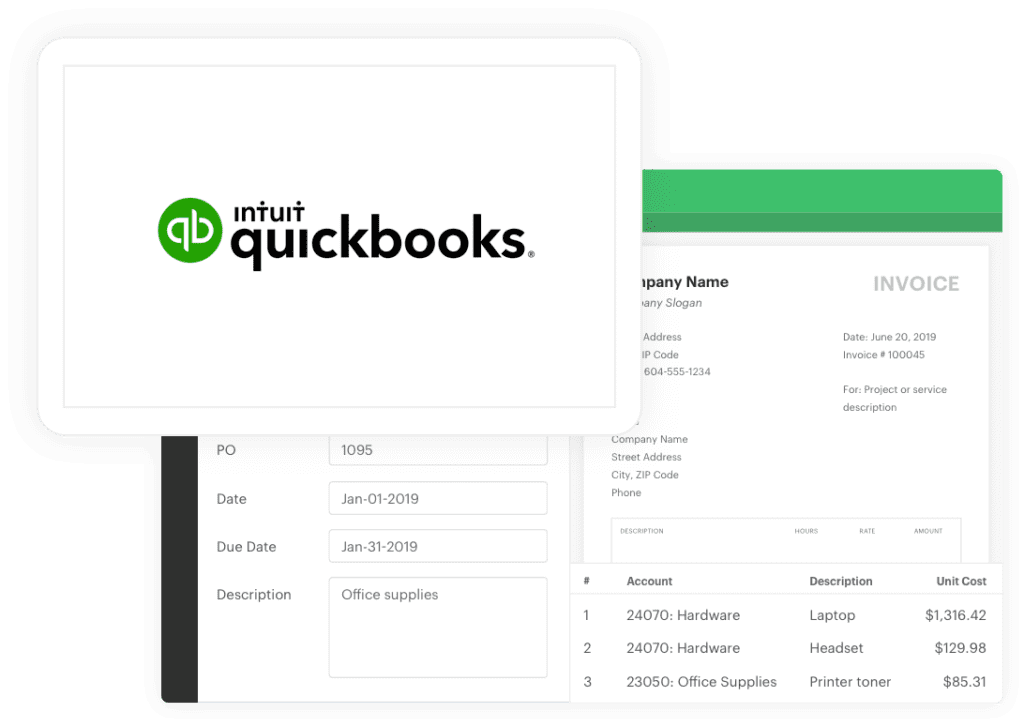

3. Billing and Invoicing

Receiving payment on time is one of the most difficult challenges for a general contractor. Ask any contractor, and they will have at least one horror story about not receiving payment even six months after completing a task, or worse, not at all!

But if you use QuickBooks for construction businesses, you won’t have that difficulty. Because the software automatically generates your invoices and bids, allows you to send them directly to the customer (even in the field), and helps you get paid on time.

The best thing about QuickBooks Online is that the invoices have a professional appearance. This not only makes your company look reliable, but it also increases your business’s credibility and attracts more potential consumers.

4. Estimation for Construction Projects

When it comes to executing a construction project, it’s critical to estimate both the cost and the length of time the job will take.

If you charge your clients too much, you risk losing clients and, hence, money. If you don’t charge enough, you may find yourself wondering if you hadn’t lost the client in the first place. Estimating a project accurately is critical to running a profitable construction business.

QuickBooks for construction businesses helps you estimate the cost of each phase of the process, removing the guesswork from the job.

5. Customer Support

QuickBooks’ best-in-class customer support is another huge factor in its significant popularity among business professionals. The QuickBooks Contractor Online system is highly rated, which is a huge benefit for contractors. Users can call for direct phone help, among other choices. You can also consult an online resource library or ask your query in the QuickBooks online community.

Furthermore, because QuickBooks has an extensive user base in industries other than construction, many users have created their own support resources. There are numerous websites and YouTube videos available for a brief overview or unofficial how-to instruction.

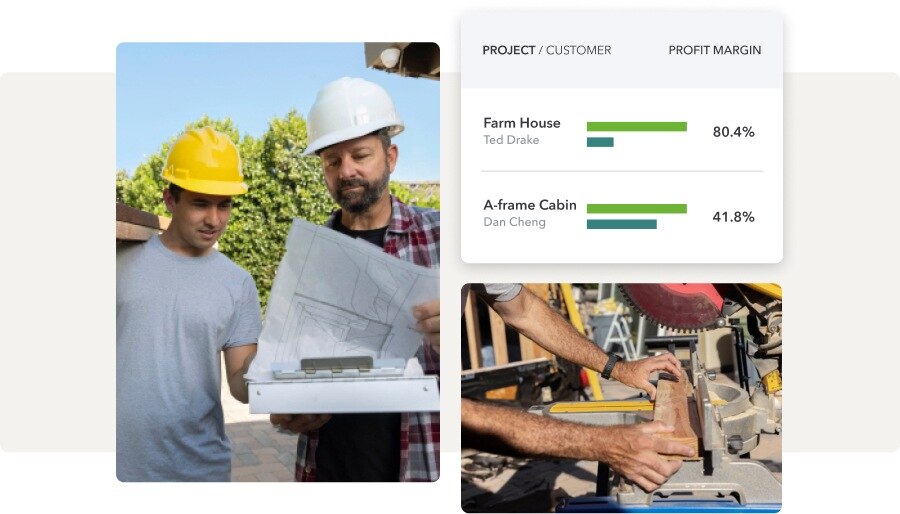

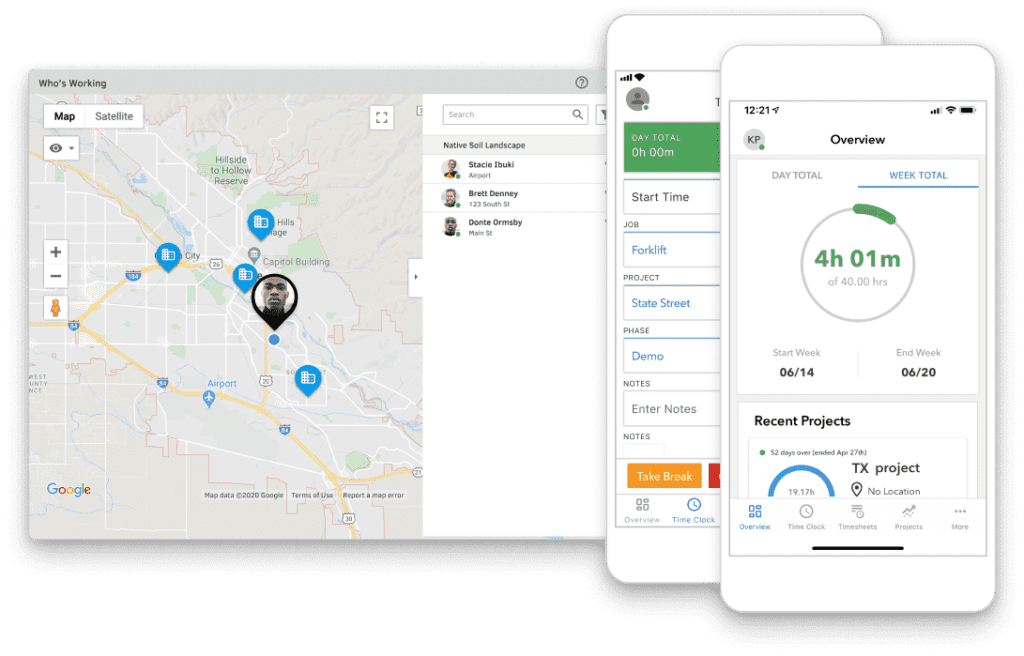

6. Tracking Project Profitability

Many contract-based firms struggle to determine whether or not their initiatives are profitable. Advanced addresses this issue by enabling you to track time and expenses for every job order as well as generate profit and job cost reports from any location. This assists you in determining which of your initiatives are lucrative and which have cost overruns.

You may isolate your hourly labor from your other project expenditures in QuickBooks Online for contractors, allowing you to better analyze your earnings from each project.

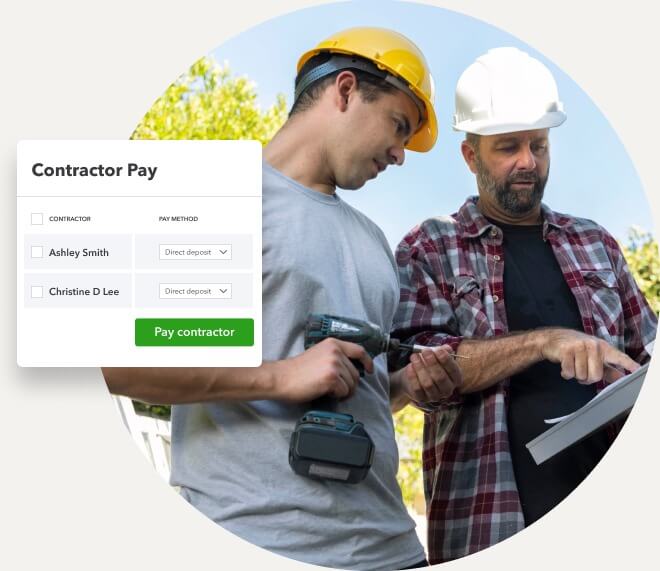

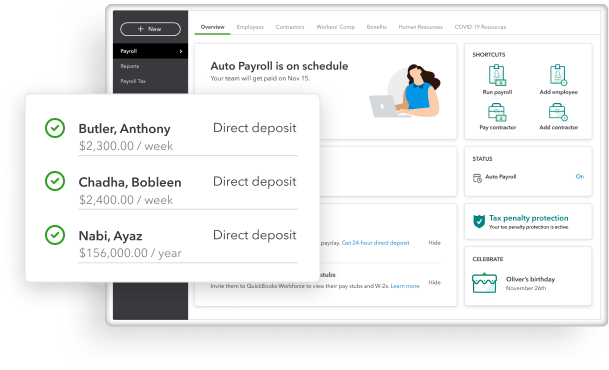

7. Managing Multiple Contractors

By automating the process of getting Form W-9 and tax ID information, QuickBooks Online enables you to handle various contractors and subcontractors. Just send an email invitation to the contractor, have them fill out their information, and you’ll have everything you need for the tax season in a matter of minutes, making 1099 reporting simple.

One of the most useful features of QuickBooks Online for construction is the ability to add up to 25 users with customizable roles and permissions so that only the appropriate individual may access and work on the appropriate content.

8.Integration with Construction Apps

While QuickBooks Online is an excellent accounting solution for contractors, it is not a comprehensive enterprise resource planning (ERP) system and thus, lacks contractor-specific management features. However, it seamlessly integrates with renowned construction programs like AutoEntry, Corecon, and Buildertrend. These integrated construction apps have the potential to transform Advanced into a robust accounting and construction management solution.

For example, while QuickBooks Online may manage your accounting, you can also link it with Buildertrend to execute single-entry estimating, building proposals, and bidding requests.

9. Remote Collaboration

Another advantage of QuickBooks Online is the ability to collaborate with team members from any location. Because QuickBooks is a cloud-based system, you can access your data saved on the platform from any device, at any time. This implies that project managers, supervisors, or other team members can create and assign work, make and send invoices, collect money, and clock in and out from their mobile devices.

10. Free Trial

Finally, one more advantage of QuickBooks for construction businesses is worth mentioning. QuickBooks Online for contractors is available for free. At the very least, it’s free for a 30-day trial period.

Of course, while 30 days may not be long enough to conduct business, it may provide you with enough information to decide whether you want to pay to try it out further. You can then decide whether you’re the right size to be a QuickBooks construction contractor or if another construction accounting software product would be a better fit.

Although QuickBooks Online is an invaluable business tool for your construction company, it is critical to understand the software before proceeding with business.

Business owners frequently proceed with a project before fully comprehending how to use QuickBooks for contractors. As a result, mistakes may occur, and the software may not be used to help your organization as effectively as it could if you took the time to learn.

If you’re just starting off, it might be a good idea to have someone in charge of handling QuickBooks, someone who has some basic knowledge of accounting as well as accounting software. This reduces the possibility of errors occurring, and the software can be used as a business tool rather than a liability.

Here are some of the most common risks associated with using QuickBooks for construction projects:

- Outsourcing of payroll

- Not tracking both income and expenses

- Not receiving payment from customers correctly or on time

- Adding job costs through the accounts and/or expenses tab

- Not using an estimating tool along with QuickBooks

If hiring someone with professional expertise to use QuickBooks Online isn’t an option for you, don’t let that stop you from using it! While having someone who is good with numbers would be beneficial, you can get help for free from online forums. Alternatively, you can opt for a reliable construction business software that offers easy integration with QuickBooks. Field Promax is a leading choice in this regard.

Final Thoughts

Although QuickBooks Online is regarded as the best accounting software for independent contractors, it is not without shortcomings. When considering QuickBooks Online for construction, consider the following limitations:

- Unlike the Contractor Edition on QuickBooks Desktop, it lacks construction and business-specific capabilities.

- You cannot automatically allocate indirect costs to jobs.

- Projects can only belong to a client or sub-customer, not to a sub-project.

- QuickBooks Online does not provide reports such as job costs by vendors.

- It is expensive to maintain and add features.

Today’s business environment has become more competitive and complex. So, it is important that you have the right resources to face the challenges. While QuickBooks Online is a good choice for construction companies and contractors, it may not be enough if you want to reap the full benefits of digital transformation.

To this end, you need a comprehensive automation solution that takes care of your accounting and bookkeeping needs as well. And this is exactly why Field Promax is the leading choice among contractors today. It is an all-in-one software solution for construction businesses that supports seamless QuickBooks Online integration. Moreover, it offers an efficient two-way sync between the two platforms, which enables you to use the same data for a variety of tasks. To explain, you can create estimates, manage job orders, assign field workers, schedule repeat work orders, create route plans, organize accounting and tax documents, manage bookkeeping, and generate invoices with just a few clicks without having to enter the same data in different forms. Not only does this save you time, but it also eliminates the risks of data entry errors, double booking, overcharging, undercharging, and not filling out tax details on time.